Gambling Mental Health

Gambling disorder is a behavioral addiction diagnosis introduced in the Diagnostic and Statistical Manual of Mental Disorders, Fifth edition (DSM-5). 1 This was the first formal recognition of behavioral addiction in the psychiatry text, which is considered the 'gold standard' in the field of mental health. Gambling addiction is part of a broader category of behavioral addiction or process addiction. In basic terms, behavioral addiction means that you’re bound to a particular rewarding behavior (such. Too much time spent on gambling can also lead to relationship and legal problems, job loss, mental health problems including depression and anxiety, and even suicide. Myth: Having a gambling problem is just a case of being weak-willed, irresponsible, or unintelligent.

Polly Mackenzie, Director, Money and Mental Health

Polly Mackenzie, Director, Money and Mental HealthMaking self-inclusion work

I’ve been interested in gambling regulation ever since we started Money and Mental Health, because it’s the one area where people who know they have a problem have a special set of rights: the right to ‘self-exclude’. You can put yourself on a register which means you are no longer permitted to gamble. The best part, recognising the way addiction and compulsive behaviours work, is that you can’t then change your mind for at least six months. So you can’t have a bad day, a bad week, or a drinking binge, and get sucked back into your gambling addiction.

In our consultation paper In Control, published in July 2016, we looked at ways that the financial services and retail sectors could learn from these kind of “sticky” restrictions, and we’ll be doing more work on this in the New Year.

But, while there are things we can learn, it’s important not to get carried away with celebrating the model that exists for gambling. The truth is, the harder you look, the more inadequate it seems. This month, we submitted recommendations to the Department for Culture Media and Sport on how to update the self-exclusion regime to make it work better, and provide the protection problem gamblers really need.

Mental health and gambling

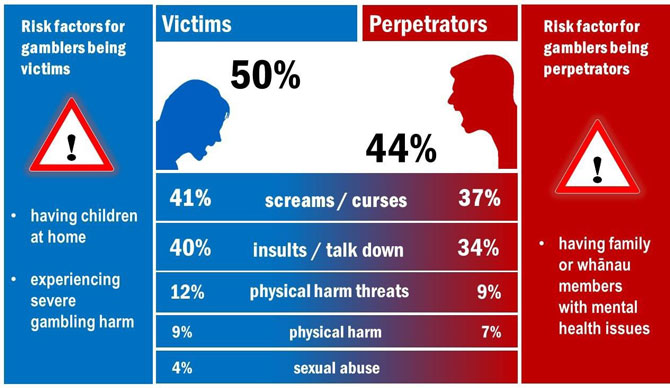

Problem gamblers frequently have coexisting mental health problems and substance misuse. People with mental health problems have a higher than average risk of engaging in problem gambling while unwell. Listen to the voices of some members of our research panel explaining how gambling is linked to their mental health:

“PTSD flashbacks keep me up and angry at night. Then I go for a kick and the best place is [high street bookmaker] to get that feeling of being on the edge and gamble.”

“My mental health condition means I gamble online when depressed. This makes me overdrawn on bank account and/or credit cards.”

Self-exclusion

The current framework for self-exclusion isn’t good enough. It will get slightly better in 2017, when you’ll be able to register once, and self-exclude from all UK-regulated online gambling instead of going site by site. But you’ll still have to register separately – and with different rules – to bar yourself from bookies, fill out a third set of forms to bar yourself from local casinos; and if bingo or arcades are a risk for you, that’s two more sets of forms to complete. It’s a wonder any problem gambler manages to self-exclude at all.

We need to make the process for self-exclusion as quick and simple as possible. Navigating five separate self-exclusion processes is simply not feasible for vulnerable consumers. A consumer-friendly system of self-exclusion would:

- Be multi-channel, with registration possible by phone, email, webchat or post and other accessible channels where needed.

- Require only a single application to register with all five schemes – or as many as the applicant wants to be part of.

- Be permanent by default, so that the applicant doesn’t have to renew every year to stay protected.

Going beyond gambling operators

But at Money and Mental Health, we believe there is more to do. Under the current regime, all the responsibility for self-exclusion lies with the gambling operators. I’ve written before about the need to allow customers to block gaming and gambling content broadcast into their homes by their TV. But we can go further. Payments providers and ISPs could really help consumers change their behaviour.

We believe card providers and payment providers like PayPal and Skrill should offer all customers the facility to block gambling transactions on their credit and debit cards. And when it comes to internet access:

- ISPs should offer the option of gambling restrictions that are not branded as parental controls.

- Mobile phone providers should offer the option of gambling-only restrictions.

- App platform providers should enable consumers to prevent themselves from purchasing gambling apps.

And, whether it’s payment restrictions, TV limitations, or online blocking tools, the most important thing to remember is this:

- All gambling restrictions should be “sticky”, so consumers cannot remove them without a pre-agreed time delay.

And finally: getting people to sign up.

A simpler, more comprehensive system of self-exclusion will only be effective in reducing gambling-related harm if more consumers are supported to enrol themselves. Simple screening of those in financial difficulty (by debt advice providers) or with mental health problems (by mental health service providers) to identify those experiencing, or at risk of, problem gambling should be introduced. Consumers should be referred to the self-exclusion regime and supported where appropriate to register themselves.

A particular at-risk group includes those prescribed medication known to trigger problematic gambling behaviour. These include dopamine agonists, used to treat Parkinsons, and Aripiprazole, an anti-psychotic. Patients prescribed these drugs should be proactively warned of the risks and referred to self-exclusion as an option before problems emerge.

Read the consultation response to see our recommendations in full

- GAMBLING IS NOT A RISK-FREE ACTIVITY;

- KNOW HOW TO KEEP THE 'PROBLEM' OUT OF GAMBLING; AND

- HELP IS AVAILABLE FOR PEOPLE WITH GAMBLING PROBLEMS AND PERSONS AFFECTED

Your Regional Gambling Awareness Team brings together representatives from treatment, prevention, recovery, and your local communities to share resources, collect data, assess community awareness and readiness, support efforts to create gambling-informed programs and services, and support the mission of PGS in raising gambling awareness across the lifespan and the continuum of care. Click on the link below for your Team point of contact. The map and town listing will identify your Region.

Mental Health And Gambling Addiction

- Regional Map - Towns (pdf)

- Point of Contact for Regional Gambling Awareness Teams (pdf)

Information: Capacity building training in your community

Youth-produced gambling awareness media through PGS partner, Capital Regional Education Council (CREC)

https://sites.google.com/site/ctyouthandgamblingawareness/student_project_resources